How to Save on Property Taxes: A Complete Guide

Owning a home comes with many financial responsibilities, one of the most significant being property taxes. No one likes paying property taxes. However, they finance many essential services, from paying civil servants to keeping our roads clean to providing education and support to the next generation.

They clearly benefit society, but why do they have to be so high? The good news is there are many ways to lower your property taxes through credits, abatements, and other government programs. There is no one-size-fits-all regarding taxes, and many different groups can benefit from these initiatives. So, if you're sick of overpaying every year, here are a few examples of how to reduce your property taxes.

At the time of writing this, the information found below were sourced by various outlets. Taxes, and programs constantly evolve, so it’s important to speak with a licensed professional or do your own research before making any decisions. This article is for information purposes only.

New York State Property Tax Relief Programs

There are several tax relief programs in New York that offer exemptions or credits to eligible homeowners. Some are statewide and others are specific to NYC. The major statewide property tax program is called the STAR credit.

STAR Credit

The School Tax Relief Program (STAR) offers property tax relief to eligible homeowners in New York State. A significant percentage of property taxes go toward funding public schools. So, the STAR credit provides a break on school taxes for owner-occupied primary residences in eligible districts.

Unfortunately, the Star Program is currently unavailable to new homeowners as a property tax exemption. However, you can still register with New York State to receive a STAR credit as a check or direct deposit. Those who have already been receiving New York property tax exemptions through the STAR program can continue to claim them or apply for a credit.

To be eligible for a STAR credit, you must:

- Live in a school district that complies with the New York State property cap

- Have an income of $275,000 or less

- Have paid school property taxes in the previous year.

There are two types of STAR benefits: Basic and Enhanced. The basic program is open to all eligible homeowners, regardless of age or income. The enhanced benefit is only available to senior citizens who earn less than $60,000 per year and offers greater relief.

New York City Property Tax Relief Programs

New York City residents have an especially high tax burden due to the local income taxes and high property values. Luckily, the city also has many programs that allow certain groups to apply for tax abatements, exemptions, and other benefits. Here are a few common ways to lower property taxes in New York City.

Condo and Co-Op Abatement

The condo and co-op abatement is a popular program that grants tax relief to eligible co-op and condominium owners. Homeowners must satisfy the following requirements to be eligible:

- The property must be your primary residence and not an investment property.

- You cannot own more than three residential units in one building.

- You must have filed a real property transfer tax form or deed with the Division of Land Records (for condominium owners only)

- You cannot also receive clergy property tax exemptions.

- The unit cannot be owned by a business such as an LLC.

However, individuals cannot apply for the abatement. Managing agents and boards must apply on behalf of the entire building, and the development itself must also satisfy certain conditions.

For instance, certain properties must submit a prevailing wage affidavit proving they pay service workers and other employees in the building enough to survive. Buildings already receiving certain tax breaks or those associated with programs such as Mitchell-Lama or the Urban Development Action Area Program are also not eligible.

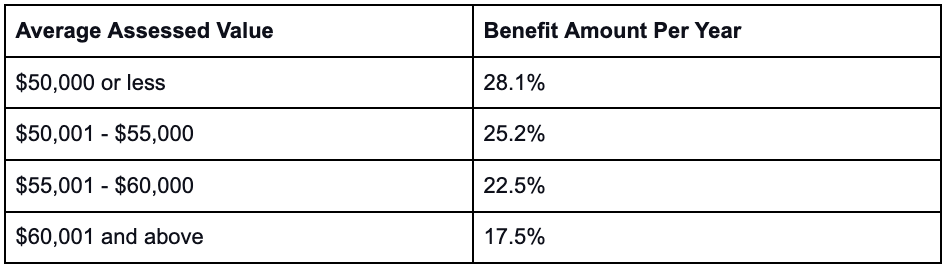

How much you can save on your NYC property tax bill depends on the average assessed value of all the residential units in the development. Here are the current rates:

If you are eligible and not receiving the abatement, you should ask the condo or co-op board to apply on your behalf.

New York Veterans Property Tax Exemptions

Veterans also receive property tax relief as a benefit of their service. There are two main New York veterans' property tax exemptions: the Alternative Veterans Exemption and the Eligible Fund Exemption.

The Alternative Veterans Exemption is available to veterans who were in foreign wars, received medals for expeditionary service, or were honorably discharged. It also applies to the spouses or widows of veterans and Gold Star parents. Eligible foreign wars include WWI, WWII, Vietnam, Korea, the Gulf War, and Iraq or Afghanistan conflicts.

The eligible fund's exemption applies to any veterans who purchased homes using "eligible funds," such as pensions, bonuses, insurance, and mustering out pay.

Exemption rates can increase depending on whether or not you served in a combat zone or were disabled in battle. However, the typical savings for a single-family home is around $600-$650. You can apply for either the Alternative Veterans or Eligible Funds tax exemptions by filing an application with the NYC Department of Finance.

Going Green Initiatives

New York also has several initiatives that can help you reduce your NYC property taxes by making eco-friendly changes to the buildings. For instance, the green-roof tax abatement is a program that offers a one-time tax reduction to property owners with buildings topped with vegetation.

A green roof refers to a roof that is entirely or partially covered in plant life. This layer of vegetation absorbs rainwater, supplies insulation, and combats what's known as the "heat island effect", which causes urban areas such as NYC to experience higher temperatures.

To qualify for the green roof abatement, the roof must be at least 50% covered by greenery, and it must be a class 1, 2, or 4 property built after August 5th, 2008. The abatement is equal to $5.23 per square foot. However, it's capped at $200,000 or your annual NYC property tax liability.

The Solar Electric Generating System (SEGS) is another popular go-green initiative. It applies to buildings approved by the NYC Department of Buildings that generate electricity through solar power. The savings you can earn from the New York solar property tax exemption depends on the start date of your service and ranges from 5% - 8.75%. However, it's capped at $62,500 or the amount of your property tax bill.

What is the SALT Deduction?

The state and local tax (SALT) deduction is a program that allows taxpayers to write off taxes paid to state and local governments on their federal income tax returns. This includes property taxes.

The SALT deduction has been around since 1913 with the passing of the 16th Amendment, which made federal income tax constitutional. However, the 2017 Tax Cuts and Jobs Act put a cap on the SALT deduction at $10,000. Currently, taxpayers can deduct either state income or sales tax (but not both), as well as certain property taxes.

New York State homeowners were among the most impacted by the cap. In 2016 the year before the cap was passed, 35% of New York State tax returns deducted state and local taxes. The average size of the SALT deduction was $21,779.

When Are Property Taxes Due?

New York State property taxes are due either quarterly or semi-annually, depending on the assessed value of your home. If the assessed value is $250,000 or less, payment is due quarterly on the first of July, October, January, and April.

However, there is a two-week grace period where you will not be charged interest. But any payments received after the 15th will be charged interest starting on the original due date (which is the 1st). If the 15th happens to be on a weekend or federal holiday, then it will be due by the following business day.

For properties with an assessed value that is greater than $250,000, payment is due semi-annually (or twice per year) on the first of July and January. If you pay your entire bill before July first, you can receive a 0.50% discount.

How to Grieve Your Taxes?

If you don't qualify for any of these credits or exemptions or you still feel your bill is too high, you have an option to grieve your taxes. Grieving allows you to challenge your property tax bill by contesting the valuation determined by the local assessor.

You don't have to pay money to grieve your taxes, and it doesn't require a lawyer. However, having representation to help with the paperwork and walk you through the process can be helpful. Each municipality handles grieving differently. So you'll have to check with your local government.

Here are a few resources to get you started:

- NYC residents: New York City Tax Commission

- Nassau County residents: Nassau County Tax Commission

- Residents outside NYC and Long Island: Complaint on Real Property Assessment

However, be aware that there are risks to grieving your taxes, so you should proceed with caution.

Mukul Lalchandani, founder of Undivided, says, "I hate paying property taxes like anyone else, but I understand the importance. Luckily, there are a multitude of options when it comes to saving on property taxes. You have to spend time to understand if you are being charged a fair amount on taxes, and if not, it's up to you to grieve it.

It can end up being an expensive process, but if you feel the amount justifies it, then it may be beneficial in the long run. However, be aware that if you grieve and your local municipality find it to be under-charged, your taxes could actually go up too.

Take advantage of the local property tax abatement programs. Just make sure to apply before the deadline. Also, keep in mind that the entire building, including your neighbors, must also participate; otherwise, you cannot."

Are there any other ways you can save on property taxes? Let us know and help share it with other readers.

If you are considering making a move in the near future, I highly recommend that you give our team a call, our premium service will ensure your home gets the undivided attention you desire. To get started, contact us today.