The TRUTH About Renting vs Buying a Home

There's a lot of online talk about how renting a home is better than buying in today's economy. High interest rates and the flexibility renting offers have convinced many people that buying a home is too expensive and difficult to make sense of financially. Well, the truth is that's absolute nonsense.

While renting is a good temporary solution for those just starting out, there are many benefits of buying a house that will always make it a smarter move, no matter what's happening in the market.

Mukul Lalchandani, founder of Undivided, says "Sure, there is a lot that's good about renting, from just paying your rent, not dealing with any of the downsides of being a homeowner, but can I say, the upside is all on the owner, not the renter.

I can tell you from experience, not just because I sell homes for a living but because I was just like you once upon a time. A true renter. I was renting until my mid-30s.

For me, I rented for about ten years before I bought my first home. If my rent was, on average, $3,000 per month, that was $360,000 gone completely. I have nothing to show for it.

However, if you were to buy a home for yourself to live in rather than rent, there are so many advantages. It is probably the best savings account you will ever have."

So, if you're still on the fence, here are the top reasons buying a house is better than renting.

Homeownership is a Hedge Against Inflation

One of the most overlooked advantages of home ownership is how it can protect your money against inflation. You've likely heard all about the dangers of inflation and how your money is worth less over time. But what can you actually do about it? One option is to buy a home.

But how exactly does that work? Let's break it down into simple math.

Historically, inflation increases by 3-5% every year. But when you get a 30-year fixed-rate loan, that loan stays fixed for 30 years. While the actual purchasing power of your money decreases, so does the present value of your monthly payment. So, it actually gets cheaper to pay for the home each month.

Let's say you buy a home for $100,000, and your monthly mortgage payment, including principal, interest, and taxes, is $500 per month. Although the taxes may increase slightly over time, your interest and principal combined payments would remain consistent for 30 years.

Think about how much $500 could buy you in 1994 versus 2024. So, as inflation increases naturally over time, the value of money decreases, and that $500 will have less impact on you over the 30 years of the loan.

The truth is not the same for renting. Rent prices naturally increase with the cost of living. So when that 3% inflation hits every year, you better believe you'll feel it. Unless you live in a rent-controlled unit, that $500 per month rental could cost you thousands in the future.

Paying Down Your Mortgage Builds Equity

Another one of the pros of buying a home is the ability to accrue equity. Equity refers to an ownership interest in an asset, and it's one of the main ways rich people create wealth.

When it comes to home ownership, equity refers to the difference between what your home is worth and what you owe the lender.

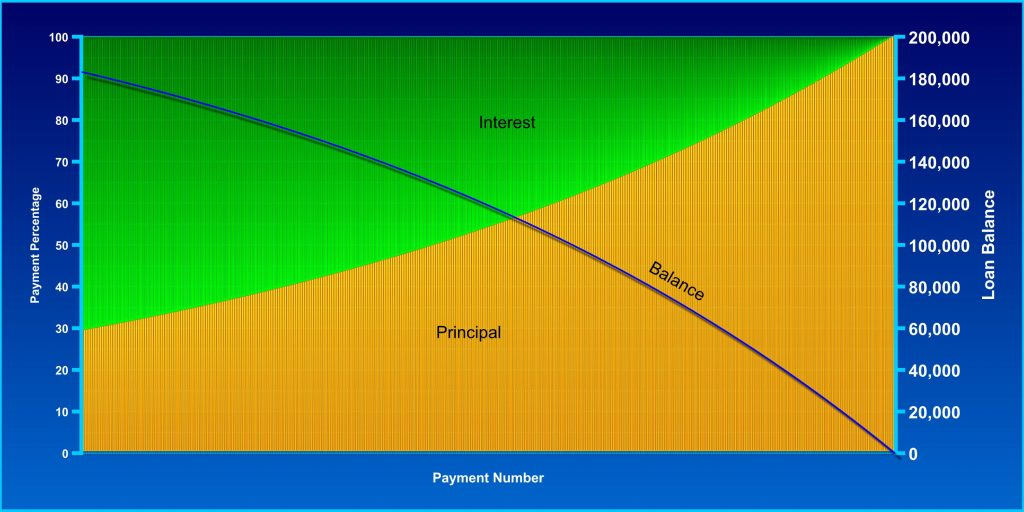

Did you know that as you pay your mortgage, the principal actually increases as the loan matures? So, with every payment, a larger portion of the money goes toward paying down your loan and building equity.

As you make each payment, you are slowly paying back the bank. At first, the lion's share of the payment will go toward the interest - or the fee the bank is charging you for borrowing the capital needed to purchase the home. However, because interest is calculated as a percentage of the outstanding balance on the loan, it slowly decreases as you chip away at what you owe. Toward the end of the loan, your payments will be mostly principal until you own the house outright.

Here is an amortization map to show you how payments toward the principal increase as your loan balance decreases:

So, paying your mortgage each month is really an investment in the ownership of the asset that is your house. Equity is cash unrealized, which is essentially how the rich build their fortunes. Not only is it a good feeling to own the place where you live, but equity can provide numerous financial benefits.

You can borrow against your home's equity at a lower rate if you need a loan for something else. Plus, if you decide to sell your home before paying off the loan completely, the more equity you have, the more profit you get to keep.

When you rent, you have no opportunity to build equity. You may be paying the same amount per month in rent as a mortgage payment, but you'll never own the building no matter how long you live there. All that money will go to your landlord, who will use the money to build equity for themselves if they don't already own the building.

The Appreciation Opportunity

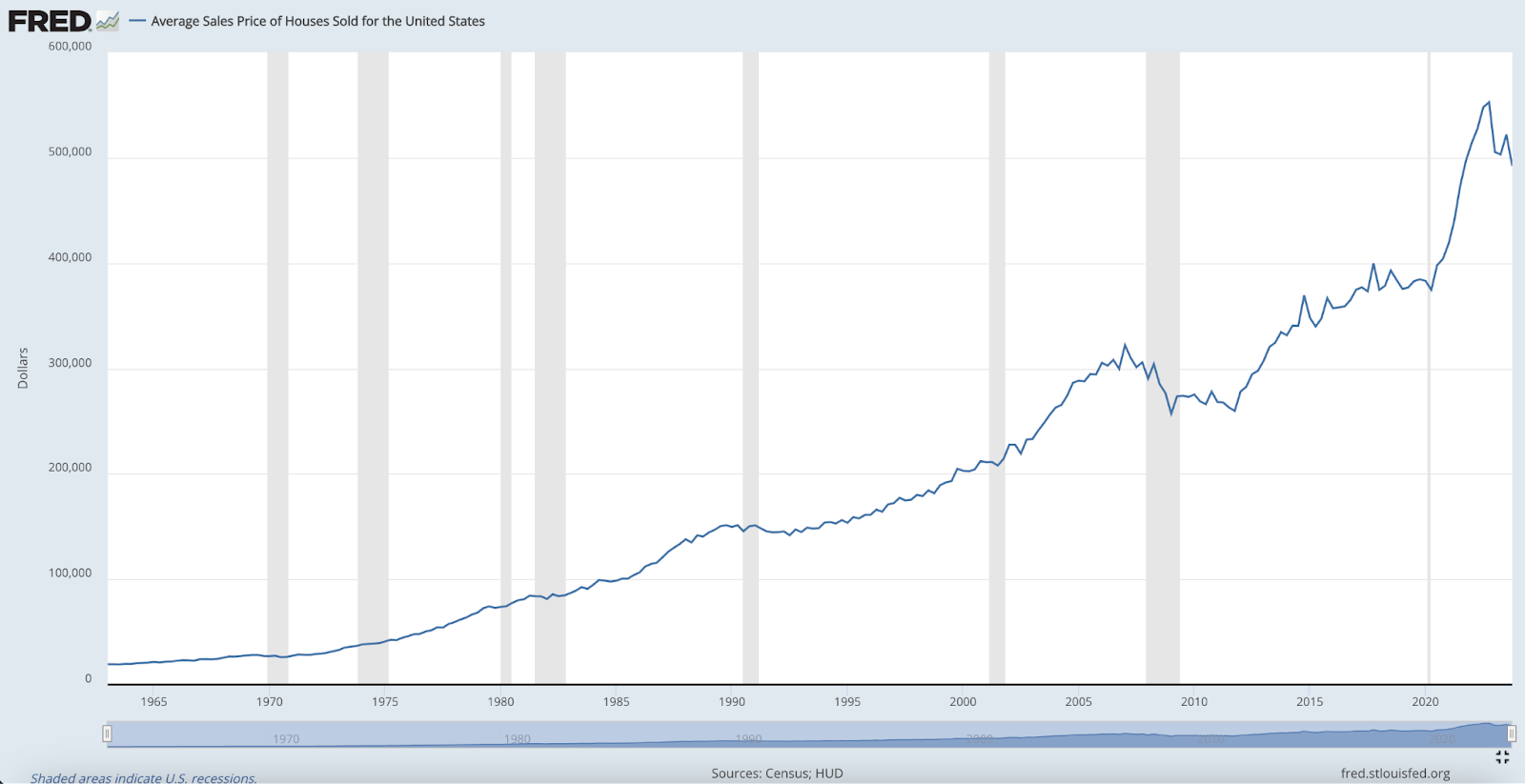

Appreciation is another one of the major pros of buying a house. Appreciation refers to the rising value of an asset. Property values naturally go up over time, so as the value of your asset appreciates, so does your equity. If you are locked in a fixed-rate loan, the amount you owe the bank will remain consistent. So, the more the home's value increases, the more you can profit once you sell.

Home prices fluctuate based on a variety of factors and occasionally decrease temporarily in a recession or market crash. But historically, home prices have continued to increase in the long run at a rate of 4.8% annually since 1987. In recent years, the home appreciation rate has increased even more than that. According to census data, the median price of a home in Q4 2000 was $172,900, while by Q4 2023 it was $417,700. That's a 6% increase per year on average.

When you rent, you don't benefit from that appreciation. As the value of the building increases, that only means a rent increase is likely on the horizon once your lease term is up. None of that money goes toward building equity so you get nothing in return for your investment over the long term.

Government Incentives

Another great reason to purchase a home is all the government incentives that are available to property owners. The government wants to promote homeownership because it not only helps individuals but also benefits society overall.

Homeownership creates generational wealth. A home is an asset that can be passed down to future generations. Homeowners also tend to be more stable and active in their communities than renters, who tend to be more transient.

Plus, the government knows owning a home makes citizens less reliant on government programs like Social Security and Medicare as people have a nest egg to fall back on. This puts less pressure on the government to fund older generations as they enter their golden years. Not to mention the countless other benefits homeowners bring, such as financing public schools and utilities through property taxes.

So, the government goes to great lengths to encourage homeownership and offers programs that are simply unavailable to renters. For instance, when you pay mortgage interest each month, you can write it off as a tax deduction at the end of the year.

Let's take the example above. If your mortgage is $500 per month, let's say the interest payment is $350. Did you know you can write off that entire amount against your taxes? So, essentially, you're only paying $150 toward non-deductible expenses.

But that's not all.

If you live in a state like New York, you can also write off up to $10,000 paid toward state and local taxes from your federal tax bill. So, along with the interest and principal, say an additional $50 per month goes toward property taxes. You can write that off as long as the amount does not exceed $10,000. So, in this example, you can deduct an extra $600 per year from your federal taxes.

Stability and Peace of Mind

Another underrated benefit of owning a home is the stability and peace of mind it provides. You don't have to worry about a landlord increasing your rent yearly or suddenly selling the building and asking you to leave at the end of your lease. You know exactly how much your monthly payment will be for the foreseeable future, giving you more control over your finances and the ability to plan for the future.

Plus, it makes it easier to establish roots, raise a family, and become an active member of your community. While it is possible to do all these things as a renter, it's much more challenging as you don't have control over the circumstances that might disrupt this peace of mind.

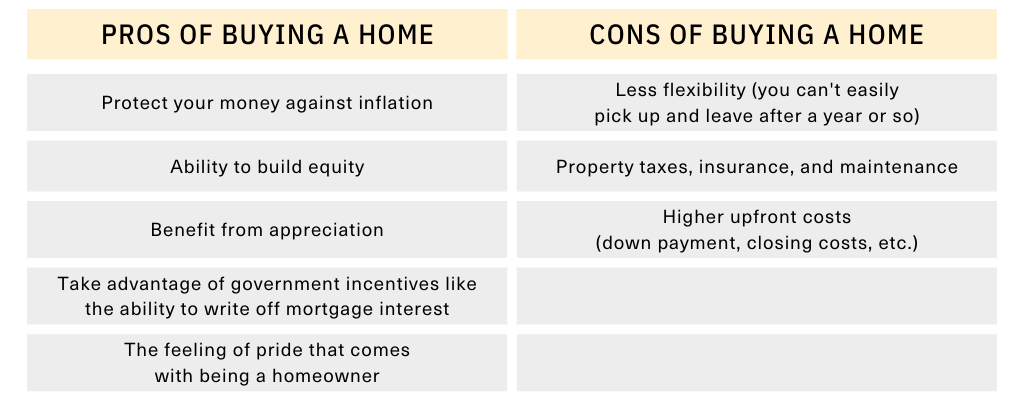

Pros and Cons of Buying a Home

So, is buying a home better than renting? Let's take a look at the pros and cons to help you decide whether to choose between a house or an apartment.

So, while no financial choice is without its drawbacks, as you can see, the benefits of owning a home clearly outweigh the negatives.

Take it from Mukul, "Don't get caught up with the rent-only hype. It's not going to benefit you, and I'll tell you, the moment I started buying properties, my life changed. As I gained more equity, I didn't have to keep "working" for the money. And this, my friends, is how you get out of the rat race."

While renting may still be preferable to young people who aren't quite ready to settle down, owning a home is the way to go for those who are more established and have the means. Plus, even if you need to sell your home before paying off the mortgage, you have options.

Ready to sell your home in less time for a higher price? Check out our premium sales program to market your property like a new build, even if it isn’t. Newly built homes receive the attention of a full sales and marketing team who work around the clock to drive up interest and demand. At Undivided, we believe that all listings deserve the same attention.

Benefit from highly effective marketing and sales systems that will help you achieve your real estate goals sooner and with fewer headaches. We specialize in helping sellers get top-dollar for their homes using comprehensive systems, first-class service, and streamlined pathways to get you the highest and best offer in a fraction of the time. Contact us today if you’re ready to sell.