Why Zillow Zestimates Are Flat Out WRONG

If you own a home, you may have stumbled across the Zillow Zestimate once or twice to see whether the price has increased. Checking Zillow and other similar home valuation sites can be a good way to get a general idea of the market conditions, but take it with a grain of salt. Zillow Zestimates are not entirely accurate, especially in a complex market like New York City. So before you list your home for way above or below what it's worth, here is a closer look at Zillow home values.

What is a Zillow Zestimate?

First, let's define Zestimate. Zestimate® is a home valuation model created by the real estate listing service Zillow that estimates the market value of a property. Zillow has developed a proprietary formula that uses data pulled from users, public records, and the MLS to arrive at an estimation. It also considers factors such as home facts, location, and general market trends.

How Are Zestimates Calculated?

Zillow has a complex algorithm that uses cutting-edge statistical and machine-learning models to analyze home data and estimate its value based on the available information. Some of the factors the Zillow algorithm takes into consideration include:

- Home characteristics: square footage, location, number of bedrooms and bathrooms, etc.

- On-market data: Listing price, description, comps, days on the market, etc.

- Off-market data: Tax assessments, prior sales, public records data

- Market trends: Seasonal trends, average prices in the area, etc.

How Does Zillow Get Its Data?

Zillow Zestimates come from publicly available property data (such as tax assessments), user-submitted data, and data pulled from brokerages. The tax assessment on Zillow means that the data was taken from a local government official responsible for determining how much a home is worth to prepare a property tax bill. This data is available in the public record, which Zillow uses when creating a Zestimate.

Zillow is also a licensed brokerage in many US states. So, it has access to listing data from the Multiple Listing Services (MLS) in certain areas that have permitted them to use their information. Finally, Zillow also allows users to input specific information about properties to improve the data and accuracy.

Is a Zestimate Accurate?

So, with all that data and state-of-the-art technology, that must mean the Zestimate accuracy is almost perfect, right? Not exactly.

Zillow's accuracy when determining a home value varies greatly based on the availability of the data and the complexity of the market. The nationwide median error rate for Zillow's home estimate accuracy is 2.4% for on-market homes and 7.49% for off-market properties. Off-market on Zillow means that the home is not currently listed for sale according to the database. However, this could also mean it is for sale but has yet to be listed on the MLS or the listing has already expired.

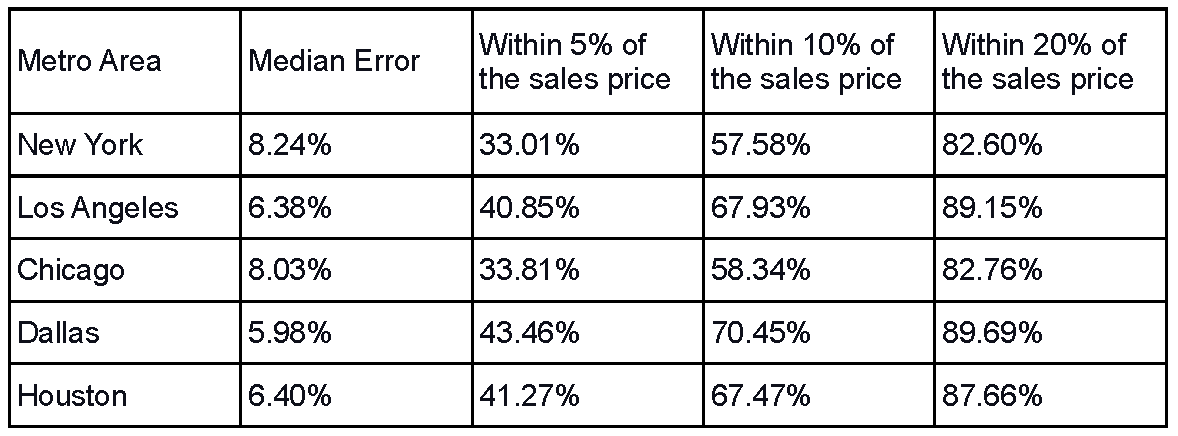

The error rate is even higher in some of the largest metro areas in the US. Here is a table showing the Zestimate margin of error for the country's top 5 largest metro areas.

As you can see, the median error for off-market properties in New York is 8.24%, and only 33% of Zestimates are within 5% of the sales price. Based on this data, you can safely assume that the Zillow Zestimate is not accurate.

Why are Zestimates So Inaccurate for NYC?

There are many reasons why Zillow's value estimate accuracy is prone to error for New York City in particular. The New York City real estate market is very complex and not easy to evaluate with a simple algorithm. The formula works better in more homogenous markets where properties with similar characteristics tend to have a similar price. But it just doesn't work that way in a vertical city like New York.

In your standard suburban neighborhood, two three-bedroom, two-bathroom homes on the same street will likely fetch a similar price, assuming one doesn't have additional amenities that set it apart. However, far more variables are at play in a city like New York. A condo might have a much higher valuation than a co-op next door, even if they are similar in size and have the same number of bedrooms.

Plus, the algorithm doesn't analyze advanced factors such as renovation conditions, quality of the residence, or the type of building. The valuation for a walk-up building will be very different from a luxury high-rise. However, the Zillow Zestimate only considers the property's location and general characteristics.

For these reasons, Zillow prices are inaccurate for many New York City homes. Too many variables go into evaluating the fair market value that an algorithm can't quickly analyze. So, while Zestimates may be good for getting some general market data, you should never use a Zillow property search to estimate the precise value of your home.

What is the Most Accurate Home Value Estimator?

You may still be wondering, is Redfin or Zillow more accurate? How accurate is a Realtor.com estimate? The truth is all these home valuation estimators have their benefits and flaws. Redfin tends to be slightly more accurate than Zillow, with a median error rate of 2.1% for on-market properties and 6.45% for on-market properties. Realtor.com is often viewed as the most accurate, as it's been around longer than Zillow or Redfin. It aggregates 99% of all MLS listings and pulls data from three different sources to compile valuations.

They each have a unique algorithm and way of estimating a home's value. But ultimately, they all still suffer from the same core problems and can't be used to determine the value of a home with 100% accuracy. Each of these websites acknowledges that their home estimator valuation tool should be used as a starting point when assessing the value of your home but should never be a replacement for a true appraisal.

How to Influence the Zillow Zestimate for Your Home

Did you know you can influence a Zillow Zestimate. Although you can’t directly change the valuation, you can help make it more accurate by updating key information about your home. Zillow pulls data from public records and the MLS, but there are no guarantees that this info is 100% accurate. That’s why Zillow also accepts user-generated data to help improve the algorithm. So you can easily go on the website and update the information to ensure it’s as precise as possible.

To do so, simply go on Zillow and look up the address. You’ll then need to claim the home by answering a few questions about the property to prove you actually own it and agree to Zillow’s terms of service.

Once you’ve claimed the home, you’ll be able to edit key facts about the property. You can update information such as:

- Number of bedrooms and bathrooms

- Home type (single-family home, condo, etc.)

- Square footage and lot size

- Year it was built or remodeled

- HOA fees

- Home or building amenities

After you edit the info it may take a few days to update and change the valuation. But if any of the data was missing or inaccurate, you’ll likely see a change in the Zestimate once you make edits.

How to Get the Most Accurate Home Valuation Possible?

So, if you can't use Zillow to estimate your home value, how do you determine its worth? The best way to get an accurate home valuation is to work with a licensed real estate professional. You can hire a real estate agent to help you pull sales data of similar properties to your own that have recently sold. Real estate agents not only have access to the MLS, but they also have a better understanding of the nuances of your local market, which may influence the property's true value. Request your home valuation at Undivided.

If you want to be absolutely certain of your home's value, you can also hire an official appraiser to come and analyze your property. Appraisers are certified by the state to provide an unbiased estimate of what a home is worth. This is the system banks use to underwrite and approve a mortgage. A home appraisal will cost you about $300-$500, but it's the most accurate way to determine how much your home is truly worth.

Ready to sell your home in less time for a higher price? Check out our premium sales program to market your property like a new build, even if it isn’t. Newly built homes receive the attention of a full sales and marketing team who work around the clock to drive up interest and demand. At Undivided, we believe that all listings deserve the same attention. Our premium sales program is specially designed to provide the same level of service to sell your home, even if it isn’t a new build.

Benefit from highly effective marketing and sales systems that will help you achieve your real estate goals sooner and with fewer headaches. We specialize in helping sellers get top-dollar for their homes using comprehensive systems, first-class service, and streamlined pathways to get you the highest and best offer in a fraction of the time. Contact us today if you’re ready to sell.

Ready to Get Started?

Here's what you'll get:

✓ Curated Listings

We handpick properties that fit you, saving you time by showing homes that match what you want.

✓ Luxury Amenities

We highlight top-tier amenities so your new home delivers the prestige and quality you expect.

✓ Market insights

We provide detailed market comps and insights to guide your decision-making with confidence and clarity.